Debunking the unaffordability myth: First 30 projects will double affordable housing in Broadway corridor

Goodman Report, reprinted from the Daily Hive

It’s time to put an end to the increasingly common – but completely inaccurate – suggestion that the City of Vancouver’s new, denser zoning regulations will chase lower income renters out of the Broadway corridor. We at Goodman Commercial reviewed the first 30 residential and mixed-use applications submitted under the City’s Broadway Plan and the statistics comprehensively debunk the propaganda that affordability will be worsened by new development in established apartment neighbourhoods.

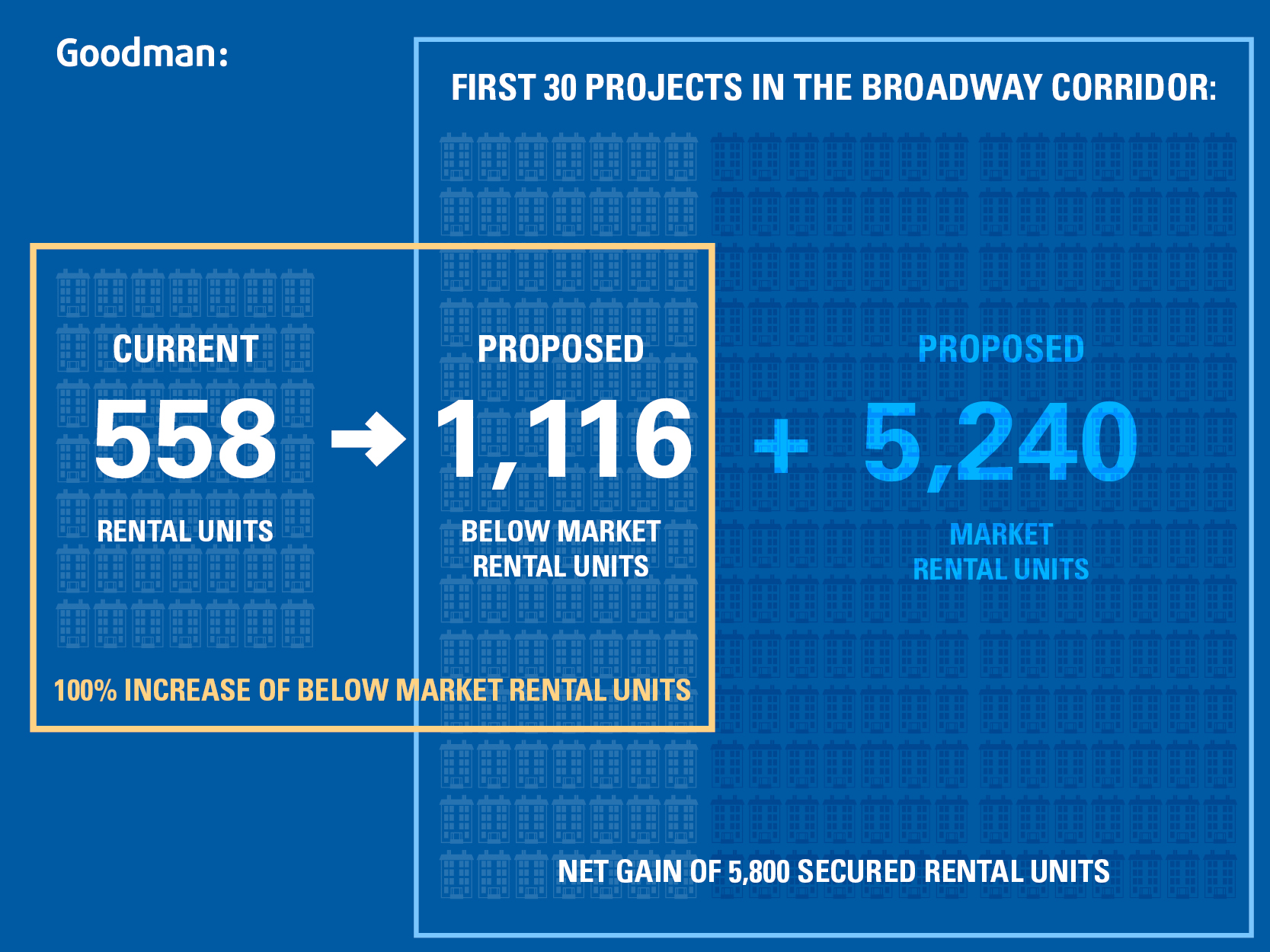

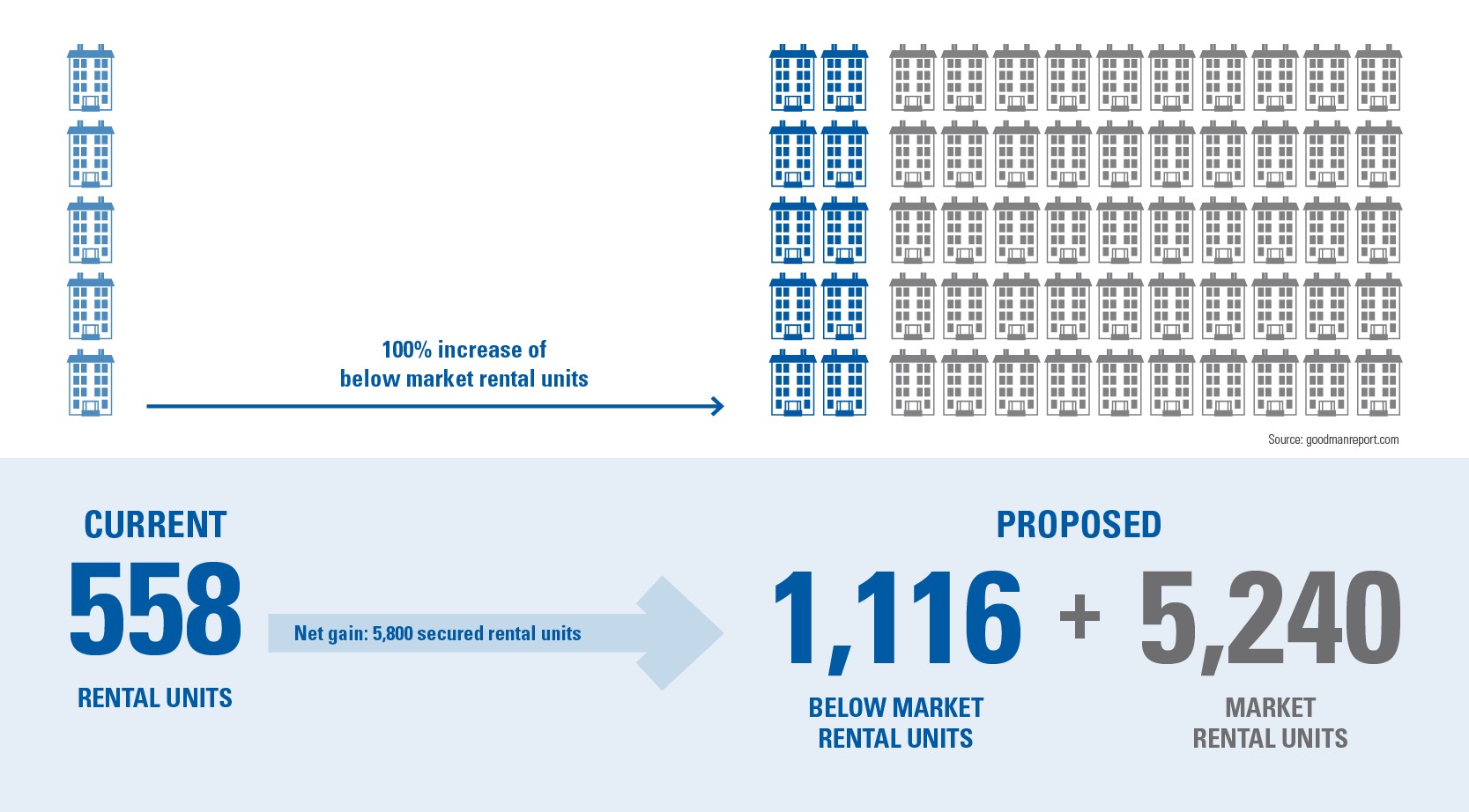

First, the proposed projects would deliver a massive increase in the total number of rental suites, providing a net gain of nearly 5,800 secured rental units. (Only one of the 30 rezoning proposals is for market-based condos.) And while half of the projects involve sites that currently have one or more rental buildings, the City’s inclusionary zoning policies are such that the 558 units will be replaced by twice as many units (1,116) that will be held at below market rents in perpetuity.

Contrary to recent fear-mongering, the tenant protections give displaced tenants an absolute right to move into new buildings at the lower of their current rent or 20 per cent below Canada Mortgage and Housing Corporation (CMHC) averages for the proposed unit type, which translates to roughly 50 per cent below actual market rents in new buildings. Relocated tenants are also protected from rent increases during construction, as developers are on the hook to find tenants interim accommodations and to cover any difference from their current rent.

To establish an accurate baseline for the distribution of rents in the neighbourhood, we examined rental rates from 453 units in 22 rental buildings across various parts of the Broadway Plan area and found that 64 per cent of tenants are currently paying more than the maximum rents mandated for new below-market units. Thus, among the renters who may be displaced by new construction, none will be worse off than before their building is redeveloped: 36 per cent will continue paying the same rate, while 64 per cent will see their rents go down when they move into the new building.

And remember – there is no income test for tenants exercising this right of first refusal. Rather than below-market units being reserved for those in-need of support, a tenant currently paying $2,400 for a one-bedroom suite in a dated building will be moved into a brand new one-bedroom for $1,429 a month, regardless of their income.

It’s worth considering, too, that tenant protections only benefit those lucky enough to have already found an apartment. Everyone else is forced to compete in a critically constrained market. According to CMHC’s latest Rental Market Report, the average rent for a one-bedroom apartment in Vancouver that was vacant and available in October 2023 was $1,967 per month; two-bedrooms averaged $3,007 per month. Compare that to the City’s maximum rent for new, below-market units at $1,429 per month for a one bedroom and $1,969 per month for a two-bedroom. If these new Broadway projects go ahead, anyone moving into the area or relocating from their existing unit would find twice as many affordable units, guaranteed at 25 per cent to 35 per cent below the current going rate.

What’s more, there will also be 5,240 additional market-rate units, and while these may command a premium over the suites in 50- to 60-year-old buildings, they will massively increase choice and reduce pressure in a tight rental market. That’s 5,240 households no longer having to compete for the few units turning over each month in the existing rental stock. While these may not be deemed “affordable” by many measures, they are in high demand and thus clearly affordable to many.

A final consideration is that half of the first 30 proposals are on sites with no tenant displacement, including lower-density commercial properties, surface parking lots, duplexes, and single-family homes. At today’s prices, with a 20 per cent down payment, the mortgage cost for a duplex in this area would be over $10,000 per month. On a single-family home, it would be over $15,000 per month. If affordability is the goal, replacing six $10,000-per-month duplexes with 150 rental units is a no brainer, even if they’re going for $3,000 per month market rent.

There is, in this positive story, a serious caveat: all this affordability comes at a cost. In today’s tough environment where even market projects are struggling to get off the ground, it’s not clear how many developers will be able to move forward with these projects without additional support. Still, contrary to dire warnings that new development will erode affordability throughout the Broadway corridor, the numbers show an across-the-board benefit for renters: more apartments available at all price points; twice as many affordable units available at lower rents; and strong protections for existing renters, more than half of who will see their rents reduced if they are moved.