Lower Values, Higher Taxes: Welcome to 2026

By Diana Pan and Stuart Slaven for the Goodman Report

Apartment building owners are under pressure across Metro Vancouver, with rents continuing to soften and CMHC recently announcing vacancy has risen to the highest level in over 30 years.

In this environment, the most effective lever owners have to maintain value isn’t on the revenue side – it’s controlling operating expenses. Property taxes are one of the largest single costs for apartment buildings and one of the few owners can actively manage.

2026 property assessments have been mailed, and while many multi-family properties are seeing modest declines from last year, that’s created a false sense of relief. Lower assessments don’t automatically translate into lower property taxes – in many cases, owners should prepare for the opposite.

Property taxes in BC are calculated by multiplying your assessment by a tax rate that municipalities adjust to meet their budget, and municipal budgets continue rising across British Columbia. Even where cities have publicly committed to “flat” budgets, tax rates are still likely to increase once non-municipal components are factored in.

Sorry Mayor Ken Sim, zero doesn’t mean zero.

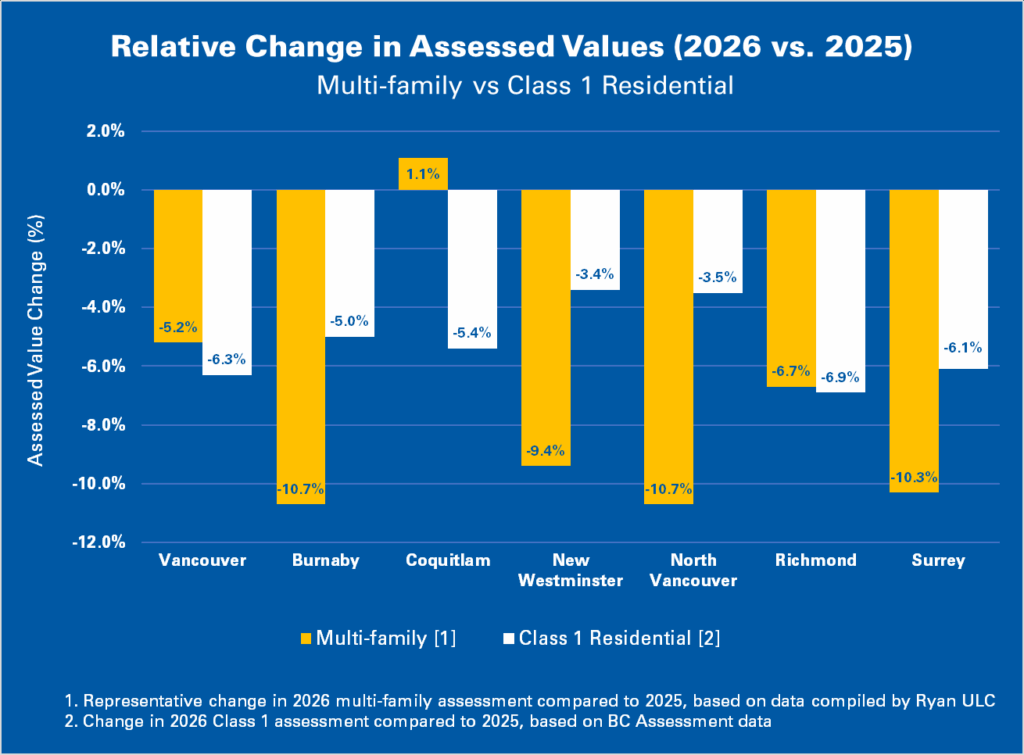

What’s more, the residential tax base is constantly shifting. If single-family home, condo, and townhouse assessments declined more than multi-family properties, a greater share of the tax burden shifts onto apartment buildings. In that scenario, owners can face tax increases despite assessed values declining.

A useful rule of thumb: if your apartment property’s assessment declined in line with – or less than – the typical residential property in your municipality, your property taxes will likely increase in 2026.

Assessments aren’t final, and they aren’t infallible. Owners have until February 2, 2026, to file an appeal. Common reasons include incorrect property classification, inaccurate unit counts or inventory details, optimistic rent assumptions, or assessments out of line with comparable properties. Assessors rely on mass appraisal models that work well at scale but don’t always capture property-specific realities like deferred maintenance, functional obsolescence, or income constraints.

Reviewing assessments annually is prudent for apartment owners, particularly when market conditions have shifted. Successful appeals can produce meaningful tax savings – not only in the current year, but for years to come.

Diana Pan and Stuart Slaven are property tax specialists at Ryan ULC, a global tax services firm, advising clients across British Columbia on property assessment reviews and appeals.