The story behind the stats

Goodman Report

What stands out about 2020: the resilience of the multifamily asset class

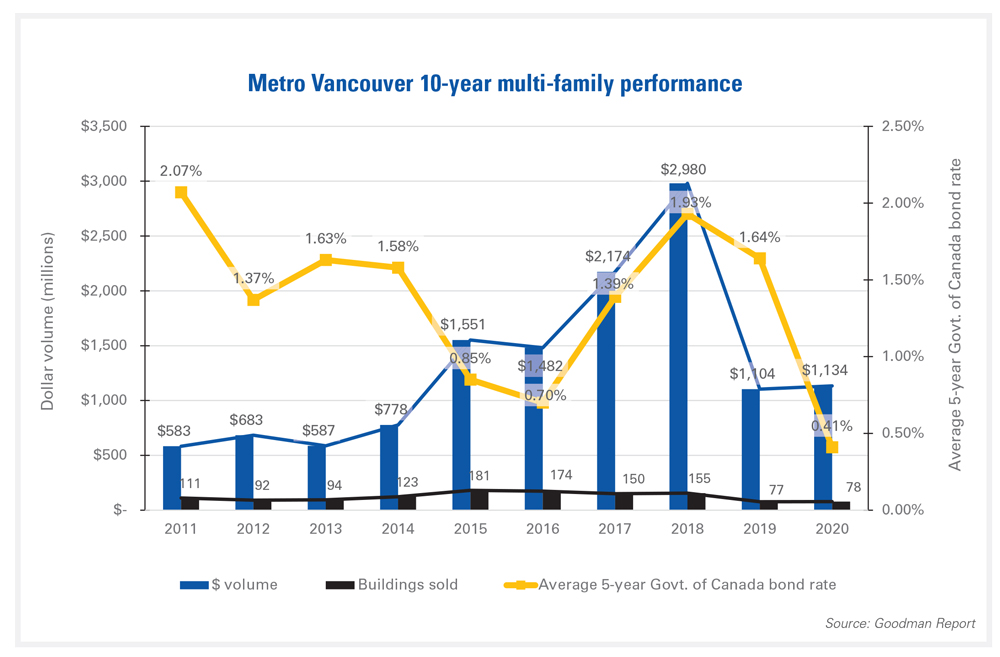

Despite COVID’s economic headwinds, the year ended similarly to 2019. The halfway point of 2020 saw apartment building transactions decrease by 36% compared to the same period in 2019, which was a year that suffered immensely from government intervention and ended with the lowest number of buildings sold over the past decade. However, as the world began to adjust to a new normal in 2020, the second half of the year marked a turning point. Multifamily assets became the preferred choice of investment, as tested by strength and performance in times of stress.

The Metro Vancouver market saw a total of 78 properties trade in 2020, just one fewer than the 77 in 2019. Corresponding with the minor change in overall sales, total dollar volume increased by a slight 2.7% over the year to $1.13 billion. Average per-door prices in the region increased by 8% to $403,088. Three significant City of Vancouver transactions, including the sale of a $120,000,000 new concrete building at 333 E 11th Avenue, a $70,000,000 sale of a tower + infill opportunity at 5455 Balsam Street, and a $82,500,000 sale of an entirely renovated concrete highrise at 500 W 12th, represented 24% of the total Metro Vancouver sales volume.

After being outsold by suburban areas in total sales volume and buildings in 2019, the City of Vancouver reversed course in 2020 with a stunning $674 million in sales and 46 buildings sold: an increase of 53% and 28%, respectively, over the previous year.

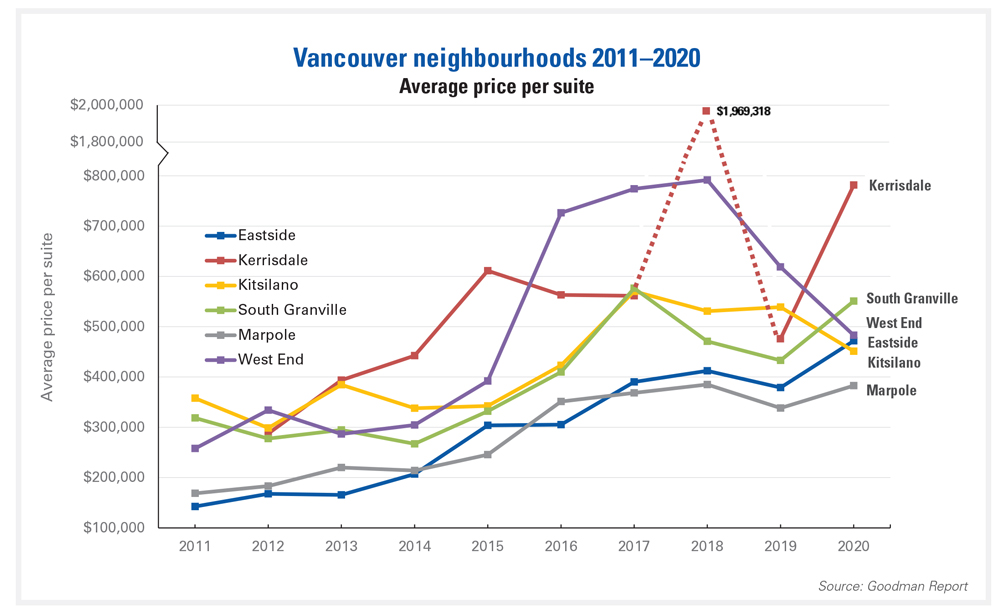

Highlights in the City of Vancouver include the South Granville neighbourhood, which saw a 120% increase in building transactions. Planning is now under way for the Broadway Corridor, where it could be said that buyers are staking positions, as 10 of the 11 properties sold all fall within the study area.

Kerrisdale’s average price per unit skewed surprisingly high to $782,000 per unit, but note that there were only 2 transactions, which were not typical apartment building sales. One had a significant infill development component; the other was a mixed-use complex with redevelopment potential.

The West End experienced a whopping 400% surge in sales, from 2 buildings in 2019 to 10 in 2020. The pandemic proved the tipping point for some vendors already exhausted from years of policy-related aggravation. The provincial government introduced a freeze on rent and evictions, leaving building owners once again to fend for themselves. However, this period also presented an opportunity for buyers seeking to own an apartment building in one of Canada’s most prized rental neighbourhoods.

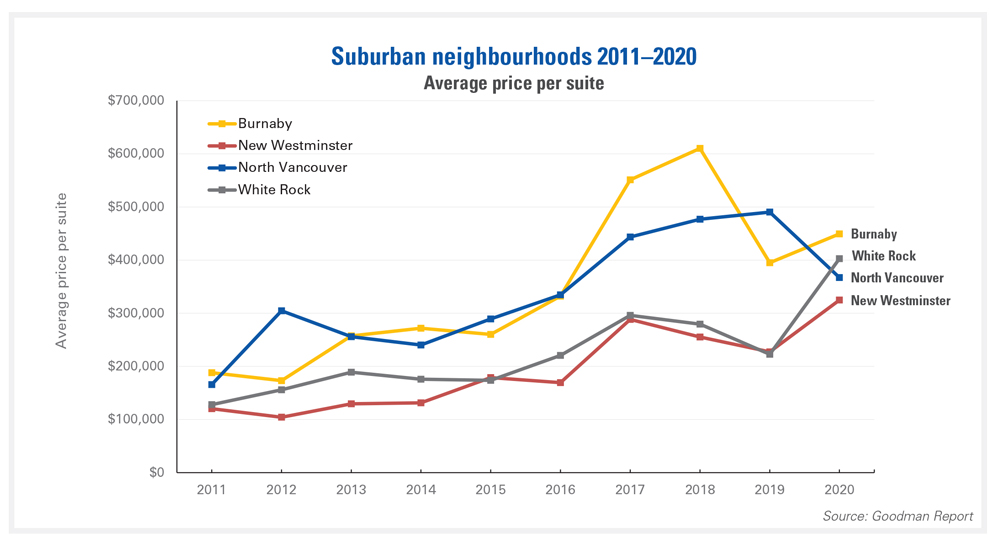

As in 2019, the City of Burnaby faced another year of dismal sales. A pattern of price discovery is apparent in the market, as apartment owners and developers strive to comprehend the economics behind development after the onslaught of new rental policies brought forward in early 2019. Overall, the suburbs witnessed a 22% decrease in buildings sold over the year. Maple Ridge was the only area that saw an increase: 200% with 6 buildings sold. A total of 8 buildings were sold in North Vancouver in 2020, 2 fewer than the previous year. Yet it’s the decrease in total development sites sold that is noteworthy: 80% of North Vancouver buildings in 2019 were sold for their development potential, while that number amounted just to 25% this year. Clearly, the pandemic has led to a more conservative approach to due diligence, sharpening the cost of inputs along the way.

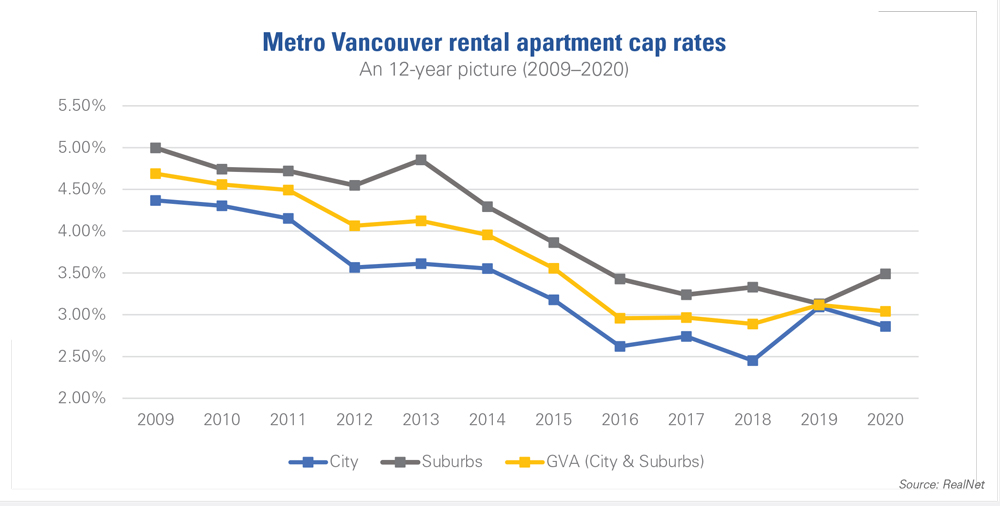

Overall, while many anticipated that the market would face great difficulties in a year full of surprises, prices and activity remained relatively stable. Historically low financing coupled with a search for safety and security in the market sustained the economic foundation of Metro Vancouver apartment buildings.

To read the complete 2020 Metro Vancouver Rental Apartment Review, click here.